Legacy brands can print cash when you play it right.

Want to print cash fast?

Buy a brand that had massive success some time ago, and show Gen-Z why they should love it.

True Religion just sold a controlling stake to ACON Investments, and it’s a textbook lesson for brands who want to scale or revive their business without burning everything to the ground.

If you’re not familiar, True Religion was a monster in the 2000s.

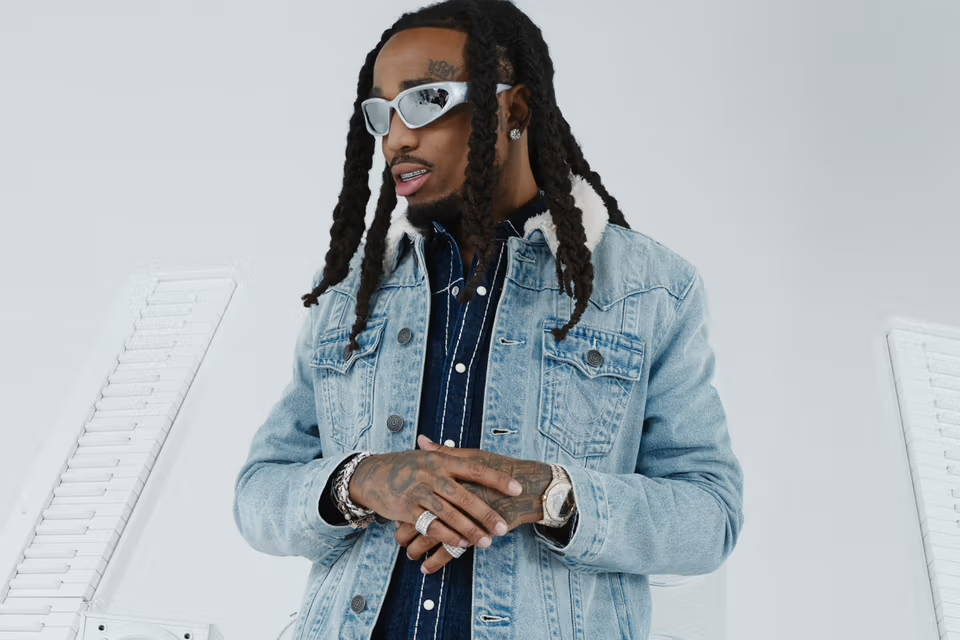

Premium denim.

Big stitching.

Celeb-fueled hype machine.

Then, like a lot of brands, they lost their edge.

Trends shifted, competitors got louder, and suddenly, they were just another forgotten icon on the rack.

ACON saw the opportunity. They’re not just throwing money at a struggling fashion house—they’re betting on a comeback story.

Why?

Because legacy brands can print cash when you play it right.

Here’s what’s smart about this move—and how other brands/equity firms can steal the playbook.

1. They’re Buying the Brand’s Attention, Not Just the Business

True Religion has something most brands would kill for: brand equity.

People still know the name, even if they haven’t bought a pair of jeans since the iPhone 4.

Acon isn’t reinventing the wheel. They’re leveraging existing brand heat and modernizing the distribution game.

Think: expanding digital, ramping up international markets, tweaking the product line just enough to stay relevant without losing the OG audience.

Compare that to Liquid Death—killed it with a basic product (water) because the branding was so outlandishly good.

They sold attitude, not just hydration.

2. Product Expansion Without Losing Core Identity

This isn’t some random “let’s launch perfume and a tech line” nonsense. True Religion plans to diversify smart—leaning into their roots but expanding into categories that make sense for their audience.

Look at Crocs.

Ugly? Sure. But they didn’t just ride out the ugly shoe wave—they collabed their way into fashion relevance.

Balenciaga x Crocs.

Post Malone x Crocs.

It wasn’t about changing the product. It was about stacking culture on top of their identity.

3. Reviving Through Distribution Power Plays

ACON isn’t just flipping jeans—they’re thinking distribution first.

More retail presence.

Smarter digital channels.

Global expansion.

HanesBrands just pulled a similar move by leaning hard into e-commerce and influencer partnerships.

Result? Record DTC sales despite being a legacy basics brand.

4. Buying Attention = Buying Revenue

This whole deal isn’t about creating a new category.

It’s about capturing attention and monetizing it better.

And the formula works:

- Relaunch a familiar name.

- Modernize marketing and distribution.

- Profit off the brand’s existing cultural footprint.

Look at Abercrombie.

Same playbook.

Went from mall dinosaur to Gen Z favorite by tweaking fits, improving inclusivity in campaigns, and dialing up their e-comm game.

Key Takeaway for Brands Trying to Break Out or Bounce Back?

Stop focusing only on product.

Nail distribution.

Nail brand equity.

Nail audience targeting.

Then pour gas on the fire.

ACON isn’t just betting on True Religion. They’re betting that legacy brands can make a comeback if you modernize their storytelling and customer acquisition.

And you?

Whether you’re building from scratch or reviving a sleeper hit—stop trying to win on product alone.

Win on

attention first.